Lasting Impact for Changing Healthcare

At Quadria, we are committed to partner with all our portfolio companies on their respective Impact and Environmental, Social and Governance (ESG) journeys.

We believe that adopting a sustainable impact approach is fundamental to our success in building meaningful businesses and delivering superior financial returns.

IMPACT THESIS

Driving Impact Through Our Actions

The need for quality, accessible and equitable healthcare across Asia has never been greater. Populations across the region continue to expand, with an unsustainable disease burden on healthcare systems. South and Southeast Asia is home to more than 2 billion people and accounts for over 55% of the world’s disease burden. Despite this overwhelming need, healthcare investment in the region remains significantly below that of developed countries, resulting in a huge demand-supply gap.

At Quadria, we believe healthcare is a fundamental human right. We seek to make positive, transformational change through our portfolio companies, with the aim of bringing democratised healthcare access across the region. By fostering strong collaborations between our portfolio partners and leveraging our extensive industry network, we advance health and well-being while also delivering compelling financial returns.

Our investment strategy targets enterprises whose business models are intrinsically linked to impact, with our proprietary impact framework measuring our investments across the four following pillars:

Accessibility

Increase availability of healthcare services for universal health coverage

Affordability

Deliver care at lower costs

Quality

Support state of the art facilities and improve quality of care

Awareness

Enhance health seeking behaviour for better health outcomes

IMPACT MANAGEMENT AND MEASUREMENT FRAMEWORK

Impact Management in Three-Tiers

At Quadria, financial returns are only part of how we evaluate performance. Central to our culture is the belief that our investments should enhance patient well-being and contribute to healthier lives. To measure this impact accurately, we have developed a proprietary 3-tiered integrated framework, in partnership with world-class organisations, that guides and governs the delivery of our ESG and impact commitments.

TIER

1

Investments are guided by an impact thesis which articulates our intended impact and long-term impact goals. Our investments are focused on healthcare enterprises that generate positive impact and contribute to the accessibility, affordability, and quality of healthcare products and services while promoting awareness for improved health-seeking behaviors.

TIER

2

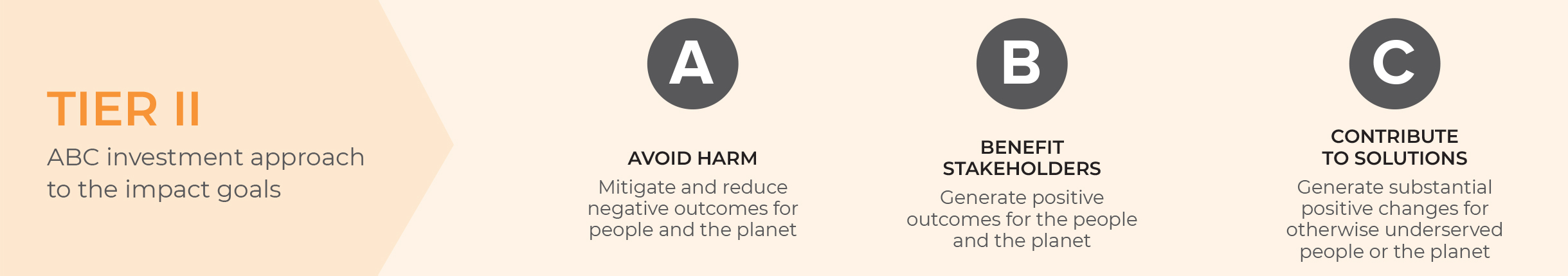

Assigning an ‘ABC’ classification – Avoid harm, benefit stakeholders, and contribute to solutions, to guide our investment strategy. All our portfolio partners, at the core, shall Benefit stakeholders or Contribute to healthcare solutions that transform the healthcare ecosystem and impact the population in line with SDG3- Good Health and Well-Being as well as contribute towards SDG5- Gender Equality and SDG 13- Climate Action.

TIER

3

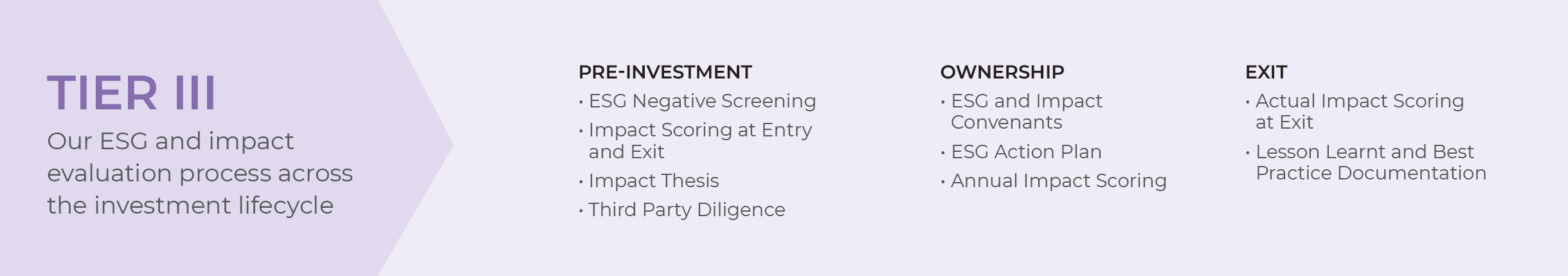

Before investing, each deal is supported by an impact thesis detailing our assessment; screening of investments in accordance with Quadria’s ESG Exclusion List, and the identification of risks and/ or opportunities through ESG materiality studies and third-party due diligence. Performance outcomes and impact are continuously monitored and tracked throughout the investment period, with a focus on understanding the realised outcomes and impacts aligned with our impact thesis and investment strategy at the exit stage.

GUIDING PRINCIPLES

Globally accepted standards and frameworks followed

Commitment to Impact and ESG

We are signatories to two esteemed international initiatives – United Nations Principles for Responsible Investment (UN PRI) and the Operating Principles for Impact Management (OPIM).

Aligned with the PRI and Impact Principles, our Impact Management Framework brings to life our Responsible Investment Policy, which represents our highest commitment to embedding ESG and impact considerations throughout the investment lifecycle.

Quadria completed its first-ever independent impact verification, affirming the effectiveness of Quadria’s IMM framework.

HEALTHCARE IMPACT CONTRIBUTION

Patients Served

Catchment Population

Presence Of Healthcare Facilities in Tier II and Tier III Markets

Patients Covered Through Government Schemes

Healthcare Facilities

Beds Managed

Employees Across Portfolio Companies

Annual Training Hours

Generic Drugs Supplied by Our Pharma Companies

Diagnostic Tests Ran

Participation of Women Amongst Workforce

“We believe private equity investors have a critical role to play in scaling up businesses that make quality healthcare affordable and accessible. Together with our portfolio companies, we are on a mission to deliver both real returns and lasting social impact.”

Abrar Mir

Managing Partner

CASE STUDIES

Stories about our Impact

Join us as we delve into the details of Quadria’s decade-long impactful journey, reflecting on our accomplishments, lessons, and most importantly, the lives we have touched and transformed:

-

Maxivision is one of India’s leading and fastest growing private eye care chains

Maxivision is one of India’s leading and fastest growing private eye care chains -

FV Hospital is a leading multi-disciplinary tertiary care provider in Vietnam

FV Hospital is a leading multi-disciplinary tertiary care provider in Vietnam

Investing for Impact

Quadria reaffirms its commitment to impact and ESG by implementing robust policies and procedures and meticulously documenting every investment phase, action, and decision from an ESG and Impact perspective.

-

Quadria Capital engaged BlueMark to undertake an independent assessment of Quadria Capital Fund III LP...2025

Quadria Capital engaged BlueMark to undertake an independent assessment of Quadria Capital Fund III LP...2025 -

Quadria Capital is pleased to share its Responsible Investment Policy, which outlines our commitment to...2025

Quadria Capital is pleased to share its Responsible Investment Policy, which outlines our commitment to...2025 -

Quadria Capital is pleased to present the Climate Action for Health Report—our first climate disclosure...2025

Quadria Capital is pleased to present the Climate Action for Health Report—our first climate disclosure...2025 -

Quadria Capital is pleased to share its Impact Strategy which reflects our commitment to embedding...2025

Quadria Capital is pleased to share its Impact Strategy which reflects our commitment to embedding...2025